Early last year, I wrote about Hilton's partnership with Autocamp, saying "I think this is also the first sign of potential market concentration – the market is relatively fragmented at the moment, but it's likely only a matter of time before a large hotel chain makes a move or a glamping brand raises the capital to start rolling up competitors." And since the writing of that newsletter, the prediction has played out to a T.

Just a few weeks ago, Marriott announced their purchase of Postcard Cabins (formerly Getaway), signaling additional interest in outdoor hospitality from the biggest players in the hospitality industry. This acquisition was paired with an additional long-term partnership agreement with Trailborn, another outdoor-focused hospitality brand, and follows Hyatt's partnership with Autocamp earlier this year.

The acquisition by Marriott represents a validation of the growing glamping economy; nature-focused and adventure luxury lodging is no longer a niche market–it’s a mainstream one.

From Getaway to Postcard

Postcard Cabins was originally founded as Getaway in 2015. Utilizing a combination of simple, Scandinavian, Instagrammable aesthetics, and cabins often placed within an accessible drive of major metros, they appealed to a growing segment of weekend travelers looking for urban escapes. They made “disconnection” a focus of their brand, encouraging guests to ditch their smartphones in a ‘smartphone lockbox’ for the duration of their stay. Unlike many other glamping options, they don’t offer common areas or WiFi. However, they also spawned an entire segment of Instagram that I like to call “look at how well I disconnected but now I’m back”, usually featuring guests lying in bed staring wistfully out the window or with a carefully arranged breakfast spread. Getaway eventually raised multiple rounds of venture capital, most recently securing $41.7 million in Series C funding in 2020.

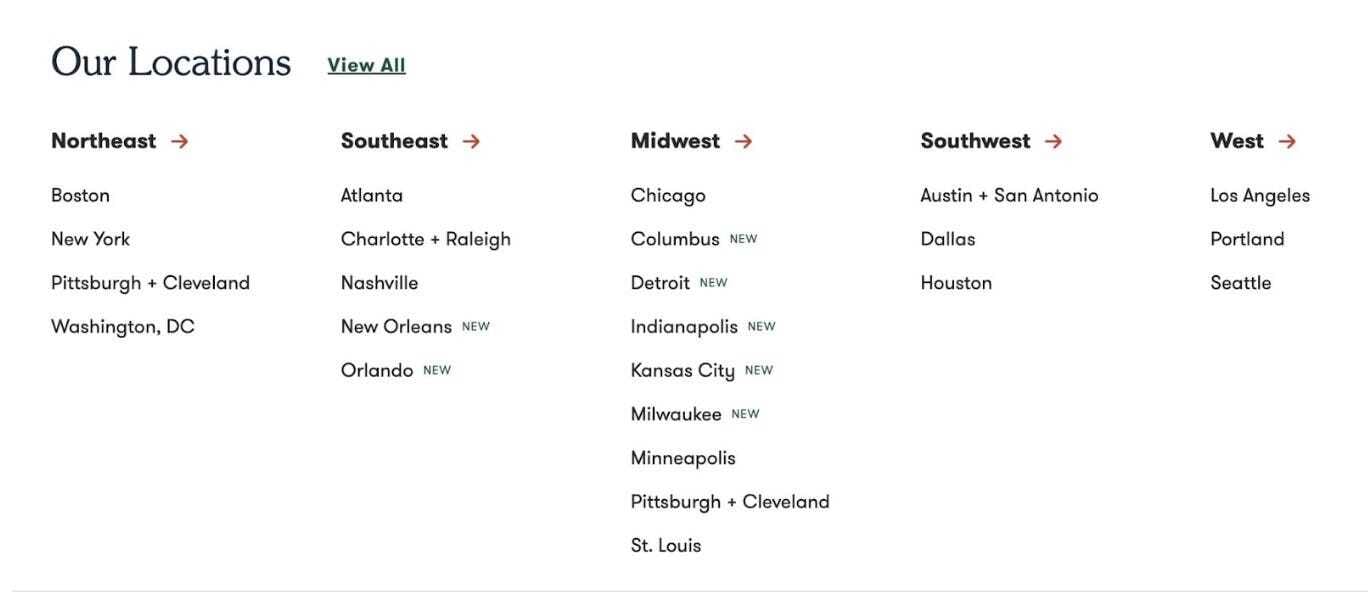

Over the last 10 years, they grew their minimal retreats to over 1,200 cabins across 29 U.S. locations. In October, Getaway rebranded as Postcard Cabins, signaling a broader vision for growth, saying "The new name will build on that foundation and better position the company to scale and offer more opportunities to deliver those experiences that create meaningful moments of connection, relaxation and reflection in nature."

Postcard Cabin’s focus on accessible urban escapes extends to the organization of their website, which focuses not on where exactly they are located, but the major metropolitan areas that they’re near. It’s an interesting contrast to other glamping and hospitality companies that tend to focus on the recognizable outdoor places they’re adjacent to (like National Parks or popular vacation locations).

Similarly, Trailborn Hotels is a relatively new hospitality company (founded in 2023) that focuses on premium accommodations in outdoor destinations. Designed to blend boutique hotel comforts with access to nature and adventure, they very much fall into the category of “revitalized hotels/motels”. Think legacy properties, redesigned or rebuilt with a mid-century design, local food options, Gestalten coffee table books, and higher end amenity options. They focus on properties in locations like Estes Park, CO, Mendocino, CA, and Highlands, NC, that have excellent nearby outdoor access, and provide a higher-end experience for guests in these areas. “When staying at a Trailborn hotel, guests are afforded access to full-service restaurants and bars, pools and unique in-room amenities that ensure guests can relax and unwind after a long day outdoors — many of these details are not available at traditional hotel accommodations in these destinations” (Travel Age West).

An Expansion into Outdoor Hospitality

Marriott’s purchases and partnerships are more than just an expansion—they’re a carefully considered strategic evolution. The hospitality giant has been a staple of cities and beach resorts, but this move acknowledges a cultural pivot toward outdoor and experience-driven travel. The pandemic accelerated interest in outdoor recreation, pushing many travelers to swap cities for cabins in the woods. In 2023, 59% of American travelers participated in outdoor adventure activities during their trips, and nature, adventure, and active travel experiences are projected to become a $1 to $1.3 trillion market by 2025. Outdoor experiences have increasingly become symbols of luxury, reflecting a cultural shift toward prioritizing adventure, wellness, sustainability, and a connection with nature (and Instagrammable stays 🙃).

Marriott also wants to remain competitive against other growing alternative travel search options like Hipcamp, GlampingHub, and Airbnb, whose recent redesign has emphasized unique stays – highlighting filters like ‘amazing views’, ‘treehouses’, and ‘cabins’ prominently on the homepage and in marketing assets.

Bonvoy, Marriott’s collection of over 30 unique hospitality brands, offers an interesting insight into changing traveler trends over time. Sub-brands like Moxy cater to younger, urban travelers, while others like Sonder cater to long stays and a growth in remote work, workcations, and longer stays. Marriott recently launched its "Outdoor Collection," which includes Postcard Cabins and Trailborn. The addition of outdoor-focused brands adds more experiential and adventure-driven options to Bonvoy, attracting travelers who value access to nature alongside comfort and amenities. It will additionally bolster their Bonvoy membership and loyalty offering, new and unique options for their current userbase, and hopefully attracting new members as well.

The increasing centralization of outdoor hospitality and the broader outdoor industry point to a shift in how outdoor experiences are marketed and consumed. Moves like Marriott’s acquisition of Postcard Cabins, Hilton’s partnership with AutoCamp, and Hyatt’s partnership with UnderCanvas, highlight the growing presence of large hospitality brands in what was once primarily a boutique market. Despite the rapid growth of outdoor recreation, there has been relatively little investment in this sector by what I’d consider “massive” companies until this year. The growth of the outdoor recreation economy means that more behemoths are likely to turn their sights to acquisitions within the industry. Large conglomerates like Vail and Alterra already control the ski industry – will major hotel chains come for all of outdoor hospitality? Interestingly, even more outdoor-focused hospitality brands like Powdr are pivoting from ski resorts to focus more on hospitality and experience offerings, dovetailing perfectly with the broader trend of outdoor recreation blending with upscale travel. When we tout the outdoors as big business, big business comes to play. Vail Resorts currently has a $7 billion market cap. Marriott, $77 billion. Hilton, $59 billion.

What's next?

The acquisition is both an expansion of Marriott’s portfolio and an indication that outdoor lodging is central to the future of travel, particularly when juxtaposed with Hilton and Hyatt’s similar partnerships. These changes signal a continuing trend toward consolidation, where major hotel chains utilize their existing resources, loyalty programs, and scale to capitalize (and hopefully dominate) the rising demand for outdoor-recreation-based travel. While this may bring soft exits and greater visibility to outdoor lodging brands, it also raises questions about the potential loss of uniqueness and local character that smaller, independent operators provide in the outdoors.