The Outdoor Industry Association (OIA) recently released its latest Outdoor Participation Report, which explores some of the 2023 trends in participation across activities and participant types. As always, it's an interesting dive into the macro side of outdoor recreation, and I wanted to do a quick exploration of some of the data, as well as a few data points that seem like contradictions at first glance.

Quick hits:

The outdoor recreation participant base grew by 4.3% to a record 175M participants, or 57.3% of the U.S. population.

7.7M Americans tried one or more outdoor recreation activities for the first time.

Image: OIA Outdoor Participation Report

The positives

By all measures, 175.8 million participants is a lot of people. People are getting outside in a myriad of ways and that's exciting to see. The female participation rate rose by 2.1%, which means more women are getting involved in outdoor activities. There's also been a noticeable increase in diversity among outdoor participants, with a 3.4% rise in participation among people of color.

The negatives

While the topline numbers look great, it hides a few more concerning trends for businesses in the industry. There are two main areas of concern: a decrease in the average number of outdoor outings, and a decrease in the participation rate of “core” outdoor participants. In 2023, the average number of outdoor outings per year was 62.5, a 25.6% decrease from 84 outings per year ten years ago. 88.4 million people participated in at least one core outdoor activity in 2023, down from the peak of 99.4 million in 2019. The decline in “very frequent” participants isn’t just significant, it’s precipitous.

A core participant is a person who takes part in outdoor activities 51 times or more in a year. That might seem like a lot, but the definition of “activity” is also quite broad. This could be everything from going on a walk, biking to work, a morning jog, playing pickleball, or doing a multitude of other more “committed” things like overnight backpacking, mountaineering, climbing, etc. So, basically if you’re “getting outside” at least once a week you’re a core participant.

Image: OIA Outdoor Participation Report

A quick reading might assume that this percentage is simply being affected by a broader participation base, naturally deflating the percentage of core participants. However, as the chart above shows, the percentage is also following a trend of decreasing overall participants. The decrease is most strongly correlated in segments of high-volume activity. Basically, we’re seeing the biggest decrease in frequent participation by people who previously participated most frequently. This is also concerning because these “hardcore” outdoorists drive much of the retail market – according to OIA research for 2024, the market was down 3% to $27.5 billion in total outdoor retail sales. Despite revenue growth in subcategories like insulated mugs and tumblers (aka, Stanley) and running, only 22 of 546 product subcategories saw growth in 2023. Casual consumers simply don’t spend as much money as core participants, who often upgrade to more expensive products and sports.

While there are increases in casual participants, the data seems to suggest that “getting more people outside” isn’t really driving long term growth or evolving into more frequent participation. OIA notes in the report that “When the drop in the actual number of core participants is coupled with significant growth in the number of total participants, we know that new participants are participating less frequently”. The profile of a casual participant is perhaps unsurprising, given the developments over the last 4-5 years. They mostly started participating somewhere around 2020 (big surprise), participate in between 4-24 activities a year, and eschew high tech gear, pushing the limits and more committed activities in favor of more casual outings. But, somewhere between getting folks outside and turning them into a frequent participant, there seems to be a level of disconnect or friction. I find this particularly interesting, given that there’s been a clear effort by many brands to shift from “core” to “casual” – more product development, branding, and marketing dollars are being allocated to attract casual participants in recent years.

Many “core” users don’t love this trend, as they see their favorite, flagship outdoor brands developing products that feel less technical and sport-specific. I like to use REI as a mirror for changes in outdoor demographics, as the makeup of their stores (for better or worse) tends to reflect changes better than “core” specialty outdoor shops. It’s pretty clear to anyone that’s been in an REI (or Dick's) recently that they’ve been pushed more towards the casual participant, with more floor space dedicated to running, athleisure, and brands that appeal to a younger demographic (Vuori, The North Face, and others). Many critics are also likely aging into their “I don’t understand the youth” demographic. However, despite this criticism, I don’t see this trend likely to change anytime soon. The data indicates that there’s work to be done on keeping this user base involved, but it also indicates that this is where growth is coming from – and juxtaposed with decreasing core participation.

Why are people getting outside less often?

Here’s where we roam more into theory and less into data. It’s less clear what the root causes of these trends are. Economic constraints are one possibility, with tighter budgets comes less recreation time and less spent on outdoor activities. Crowding and increasing the increasing difficulty of acquiring coveted permits could also contribute. Overnight backpacking has seen a significant decrease, with participants seeming to shift towards more single-day activities like hiking and running. I’d love to dig deeper into Gen-Z’s relationship with the outdoors as well – is this an untapped well of participants, or is the younger generation simply not resonating as strongly with outdoor activities due to factors like social media and an introduction to the outdoors at a time where they feel more developed than ever.

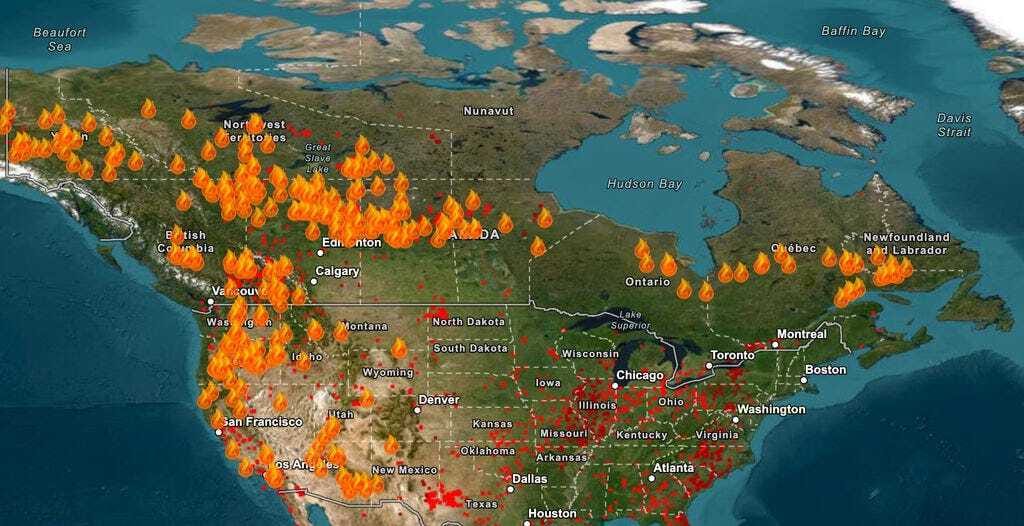

It could also be attributed to rising temperatures in certain areas – curbing both enjoyment and safety for outdoor exercise. While this participation data is for last year, it’s still reflective of a continuing trend. The high temperatures we’re seeing across the West this year will reflect negatively on tourism dollars and overall participation in next year’s data. When temperatures are unsafe and recreation headlines feature numerous heat-related deaths, I think it’s safe to assume that summer participation in impacted areas can be expected to decline. Three hikers died in Canyonlands recently, and the phenomenon isn’t just relegated to the US, with Greece also saw 10 tourists deaths this year in heat-related incidents. It's also worth considering the impact of wildfires. This week, Jasper National Park was evacuated due to a major wildfire (sadly, the fire has now reached the town itself), the Durkee fire in Oregon is creating its own weather, and much of the west is either affected by nearby fires or pervasive smoke and poor AQI. Unfortunately, this feels like the status quo for July and August in recent years.

What does it all mean?

The makeup of the outdoor industry is a constantly shifting landscape that affects retailers, brands, outfitters, and tourism. The big takeaways here are that, whatever the reason, core participants are decreasing and new participants aren’t filling that void – in overall participation, or in spending. It’s a development that companies reliant on this industry will have to figure out; and the solutions might be on two sides of the spectrum – invest heavily in casual outdoors participants, and the means to convert those to more active participants…or, “return to the roots” and try to re-engage core participants while also mitigating external threats to frequent participation. If these trends continue it could have ramifications across many segments of the outdoors.