The Bureau of Economic Analysis released their latest report on the impact of outdoor recreation as it relates to the US economy. It’s always an interesting read, full of data. This year, the headline you’ll see most often this year is that the outdoor recreation industry generated $1.1 trillion in economic output in 2022, a pretty wild milestone. (Full release and data tables)

What is “outdoor recreation”?

It’s important to note that the “outdoor industry” as discussed in this report is not an independent entity, but rather a “satellite account”, and a conglomeration of activity across a range of industries that is related to outdoor recreation. This particular definition of “outdoor recreation” is incredibly broad.

For example, the “Retail” category might include everything bought at REI, but only the sporting goods bought at Walmart. It also includes things you might not immediately expect, like the gross output from oil and gas extraction on public lands, a range of categories related to manufacturing outdoor goods, the transportation of those goods by air, water, and land, as well as finance, real estate, agriculture, construction, and more. In all, there are 95 different industry categories that make up the “outdoor recreation economy”. Here’s one example from the BEA.

Visits to Disneyland? Pickleball? Kite flying? Water parks? Golf? Gardening? Paintball? Concerts and festivals? Flights and transport costs? All outdoor recreation.

Yes, Disney World is outdoor recreation

I think it’s important to understand this, because when outlets say “the outdoor industry added $1.1 trillion in value”, readers might apply that to their personal sphere – attributing the value directly to the sports and activities they regularly participate in, rather than considering the true scope of what goes into that $1.1 trillion in gross output.

So what does the report say?

Well, by whatever measure you want to use, the outdoor recreation economy is massive, and it’s outpacing the overall US economy.

“Inflation-adjusted (“real”) GDP for the outdoor recreation economy increased 4.8 percent in 2022, compared with a 1.9 percent increase for the overall U.S. economy, reflecting a deceleration from the increase in outdoor recreation of 22.7 percent in 2021. Real gross output for the outdoor recreation economy increased 7.5 percent, while outdoor recreation compensation increased 9.1 percent, and employment increased 7.4 percent.” - BEA.

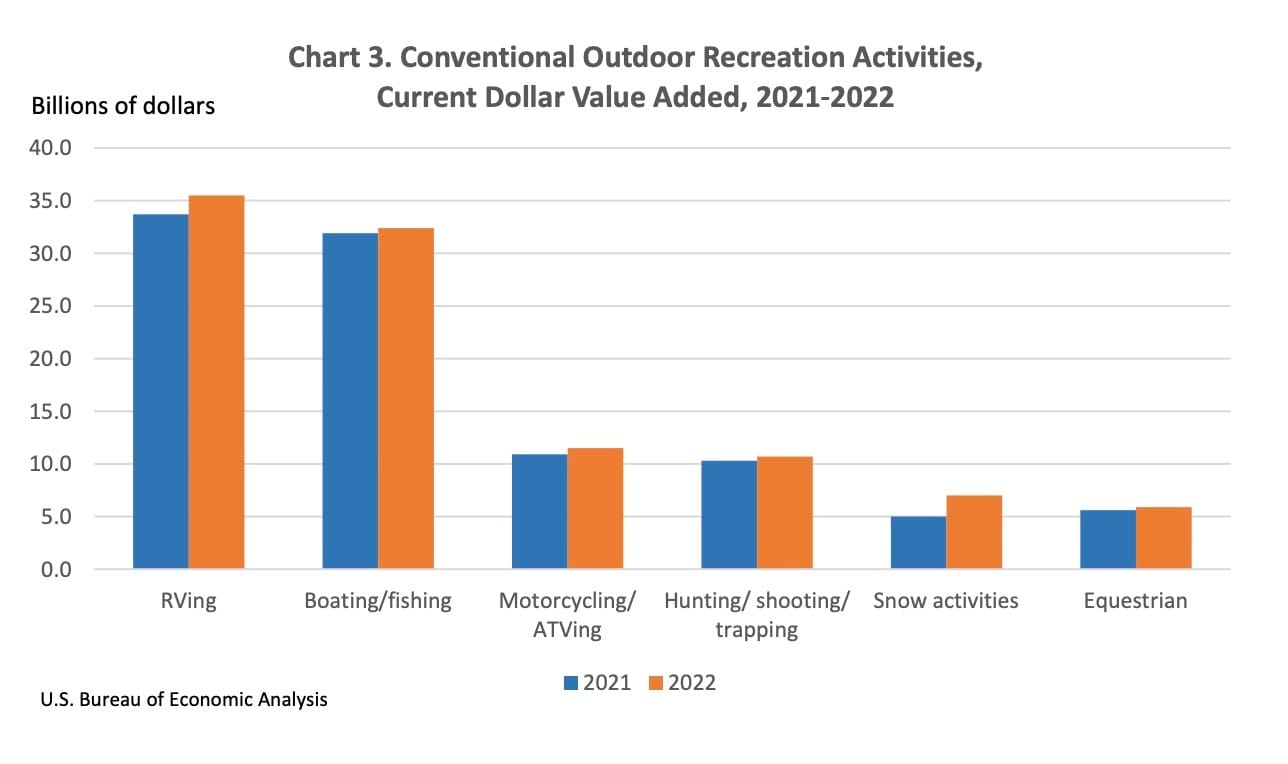

The top conventional outdoor recreation contributors for 2022 were RVing, Boating/Fishing, Motorcycling/ATV, Hunting/Shooting, Snow activities, and Equestrian. You’ll have to drop down to #7 to find Camping/Hiking/Climbing, which contributed just 1% of the total value added.

Many of the pieces about this news will feature a photograph of something like below (bicycling accounts for just .5% of the total recreation value added).

However, an image like this one might more accurately reflect the largest activity contributor to “conventional outdoor recreation”.

By industry, the majority of contributions come from retail trade. This is closely followed by “Arts, entertainment, recreation, accommodation, and food services”, and then manufacturing.

But what about inflation?

While most headlines focus on the 1.1 trillion in gross output of current dollars, for the rest of my insights I’ll primarily be using the gross output in chained 2017 dollars, a method of adjusting real dollar amounts for inflation over time, that allows for a better comparison of figures from different years. The BEA report also provides this data, although it tends to be a little less sexy (for example, it shows that gross output increased 7.4% rather than 18.7%).

Interesting tidbits

RVing remains the king of outdoor recreation with $52B in gross output. It’s seen a huge bump since 2019, although 2021-2022 saw a more modest increase in output (1.7%).

A significant amount of performance for 2022 was buoyed by the resurgence of trips and travel. While the 2022 numbers don’t quite reach 2019 when adjusted at 2017 dollars, the increase alone in gross output from 2021 is nearly the size of any individual conventional activity ($36B, on a total of $266B)

Even though I’ve written about it before and it makes logical sense, it’s still wild to me how small of a slice hiking/tent camping/climbing accounts for in this particular “outdoor recreation” pie. $8.6B in gross output is nothing to shake you’re head at, but both boating/fishing and RV are 6x more than that, festivals and concerts are 4x, amusement parks are 3x, and hunting/fishing and ATV are 2x. One explanation for this discrepancy might be that a large percentage of outdoor goods for those activities is manufactured overseas – whereas 95% of boats sold in the US are also manufactured here.

Snow activities saw a dip in 2020 (obviously), but a resurgence in 2021 and an absolutely massive year in 2022, up 32.7% YOY. I’d fully expect to see this match or exceed these levels after the monster season we had in 2023.

Other snow activities, which includes dog mushing, sleighing, snowmobiling, snow shoeing, and snow tubing grew by 56% in 2022.

Festivals, sporting events, and concerts grew by 30%, returning to pre-pandemic levels and accounting for 3.3% of industry value.

Someone needs to give me the scoop on recreational flying. It contributed a “modest” $5.1B in value but is up a whopping 82.5% from 2021, far exceeding even pre-pandemic levels.

It looks like there were a few significant post-post pandemic dips for a few water sports categories – canoeing (down 27%), kayaking (down 16.5%), and “other water activities”, which consists of boardsailing/windsurfing, SCUBA diving, snorkeling, stand-up paddling, surfing, tubing, wakeboarding, water skiing, and whitewater rafting (down 24%). Pretty significant decreases for 2022, although both canoeing and “other water activities” both remain over 2019 levels.

State level data

The** top states** by outdoor recreation value added are California, Florida (amusement parks, remember?), Texas, New York, and Illinois.** **Interestingly, states I expected to be ranked higher…aren’t. For example, Florida had $52B (#2) in value added vs Colorado’s $13.8B (#12) These states tend to vastly outpace more “outdoorsy” states in things like game areas (includes golf and tennis), amusement parks, festivals/concerts, and supporting outdoor recreation (which includes recreation-related travel/lodging/food).

Like it or not, Florida outpaces your favorite outdoorsy state in every measure of impact to the “outdoor recreation economy”

When you change that to look at how important outdoor recreation is to each state (percent of total value added), you’ll see Hawaii, Vermont, Montana, Wyoming, and Alaska at the top. This feels more clear to me, as it’s obvious the importance and impact that tourism (and particularly outdoor tourism) has in those places for both consumer spending and employment.

Wrapping up

At the end of the day, whatever the “outdoor recreation industry” is, it’s big. Reports like this will go a long way towards encouraging more states to adopt outdoor recreation offices and potentially pave the way for one at the federal level. But, as with all things, it’s important to acknowledge the broad definitions and nuance involved here – if outlets and organizations want to tout “$1.1 trillion in impact”, it should be clear where that impact is really coming from.